By most estimates, direct marketing accounts for more than half of all advertising expenditures in the US. Despite the rapid adoption of electronic forms of direct marketing, print media continues to capture the majority of direct marketing ad dollars. The Direct Marketing Association (DMA) estimates that print media accounted for about two-thirds of direct marketing expenditures in 2012. Internet search advertising accounted for about 19% of direct marketing advertisement expenditures for electronic media, followed by Internet display advertising.

Although direct mail has proven to be resilient and effective, mail volume in North America has been hammered over the past half-decade, beginning with the 2007 recession. According to the Government Accountability Office (GAO), total United States Postal Service (USPS) mail volume declined by about 20%, from 213 billion pieces in fiscal year 2006 to 171 billion pieces in fiscal year 2010. Long-term forecasts conducted for the Post Office expect mail volume to decline by an additional 150 billion pieces by 2020.

|

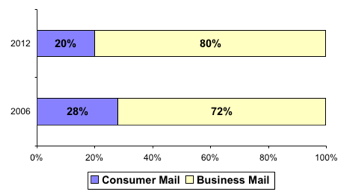

Figure 1. Consumer & Business Mail, 2006 & 2010 (Source: USPS data & INTERQUEST). |

Electronic diversion clearly impacted consumer mail much earlier and in more dramatic fashion than business mail. From 2006 to 2010, consumer (single-piece) mail lost about 35% in volume, dropping at a CAGR of about -10.0%, while business mail (First-Class and Standard combined) lost about 15% in volume, declining at an annual rate of about -4.0%. From 2010 through 2012, consumer mail continued to fall precipitously at an annual rate of about -9.0%, while the rate of decline for business mail slowed to about 2.5%. In 2012, consumer mail accounted for about 20% of USPS mail volume, compared to about 28% in 2006.

Standard Mail volume seems to have stabilized, while First-Class volume continues to decline. For the nine-month period, which ended on June 30, 2013, Standard Mail revenue of $12.69 billion increased by $354 million (2.9%) and volume increased by 1.16 billion pieces (1.9%), compared to the first nine months of 2012. The increase was boosted by political campaign mail related to the Presidential and Congressional elections mailed during the first quarter of 2013.

|

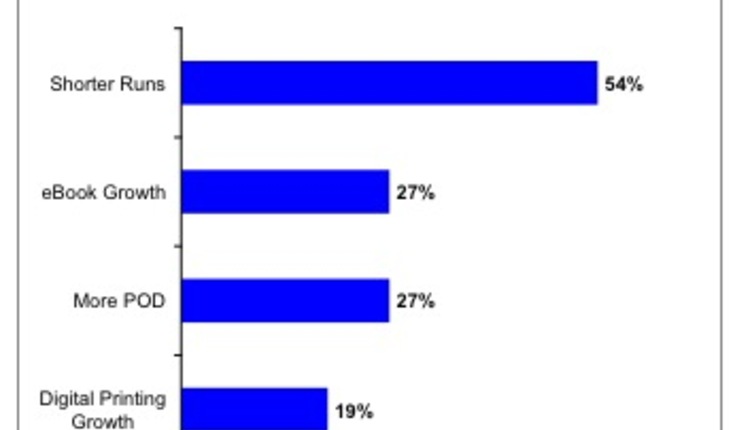

Figure 2. Leading Trends in the Direct Mail Market Cited by Respondents (Source: INTERQUEST, 2013). |

INTERQUEST conducted in-depth telephone interviews with 47 North American direct mail providers in the first half of 2013. Collectively, these companies produced well over one-quarter of the USPS’ Standard Mail volume for fiscal year 2012. The key trends these companies see in the direct mail market are familiar themes of late: an increase in segmentation and personalization, leading to shorter print runs; and an increase in multi-channel or cross-media marketing. The challenges they cite paint a picture of a market in transition, as they struggle with postal issues, making the transition from conventional direct mail to targeted direct mail providers and brutal price pressure in a consolidated market.

These changes are dramatically impacting how direct mail is produced. Currently, well over half of direct mail pieces are produced by overprinting preprinted shells using digital toner and inkjet equipment. In the future, respondents see this method tailing off dramatically in favor of single-pass digital printing using toner and inkjet presses.

In a 2009 survey of this market, we found that although respondents projected their color digital output would grow faster than monochrome digital impressions, the annual growth they projected for color impressions was relatively modest. In fact, based on our recent survey, we find that digital color output has burgeoned, increasing by nearly four-fold. As in other markets, inkjet has played a major role in increasing digital color in direct mail. Although it has not grown as fast as in transactional printing and book printing, inkjet is rapidly taking hold in direct mail as print quality and substrate flexibility improve.

The vast majority of respondents we surveyed offer multi-channel services to their clients, but this activity represents a relatively small portion of their revenue. They believe this will change rapidly in a relatively short period of time but see many hurdles to clear. Twenty-eight percent of the respondents say their biggest challenge in multi-channel marketing is educating customers on its effectiveness and proper use. Nearly one-fifth (19%) of the respondents say that their biggest challenge is effectively coordinating the delivery of different media, and the same percentage indicates that the biggest challenge in multi-channel marketing is finding employees with the necessary skills.

Direct mail volume has stabilized and direct mail remains a key marketing tool. It will never again, however, reach pre-recession levels, as electronic alternatives continue to grow and marketing becomes increasingly targeted and personalized. The transition will be tough for many direct mail providers, as they will be fighting head winds from consolidation while simultaneously retooling their services and personnel. Our survey finds that many direct mail printers are making this transition successfully and are growing revenue faster than volume. Common to most of these success stories is the foresight and wherewithal to leverage the direct element in direct mail.

These changes are dramatically impacting how direct mail is produced. Currently, well over half of direct mail pieces are produced by overprinting preprinted shells using digital toner and inkjet equipment. In the future, respondents see this method tailing off dramatically in favor of single-pass digital printing using toner and inkjet presses.

In a 2009 survey of this market, we found that although respondents projected their color digital output would grow faster than monochrome digital impressions, the annual growth they projected for color impressions was relatively modest. In fact, based on our recent survey, we find that digital color output has burgeoned, increasing by nearly four-fold. As in other markets, inkjet has played a major role in increasing digital color in direct mail. Although it has not grown as fast as in transactional printing and book printing, inkjet is rapidly taking hold in direct mail as print quality and substrate flexibility improve.

|

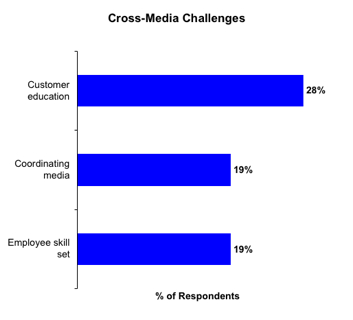

Figure 3. Leading Challenges with Offering Cross-Media Services (Source: INTERQUEST, 2013). |

The vast majority of respondents we surveyed offer multi-channel services to their clients, but this activity represents a relatively small portion of their revenue. They believe this will change rapidly in a relatively short period of time but see many hurdles to clear. Twenty-eight percent of the respondents say their biggest challenge in multi-channel marketing is educating customers on its effectiveness and proper use. Nearly one-fifth (19%) of the respondents say that their biggest challenge is effectively coordinating the delivery of different media, and the same percentage indicates that the biggest challenge in multi-channel marketing is finding employees with the necessary skills.

Direct mail volume has stabilized and direct mail remains a key marketing tool. It will never again, however, reach pre-recession levels, as electronic alternatives continue to grow and marketing becomes increasingly targeted and personalized. The transition will be tough for many direct mail providers, as they will be fighting head winds from consolidation while simultaneously retooling their services and personnel. Our survey finds that many direct mail printers are making this transition successfully and are growing revenue faster than volume. Common to most of these success stories is the foresight and wherewithal to leverage the direct element in direct mail.